Lightning Network: 7 "Aha!" moments to make it click

I recently finished reading Mastering the Lighning Network (Amazon link, Github link). This book does a great job explaining the design of the Lightning Network and the details of the protocol. I had a few “Aha!” moments while reading it and I’d like to share them with you!

Aha! A true peer-to-peer network!

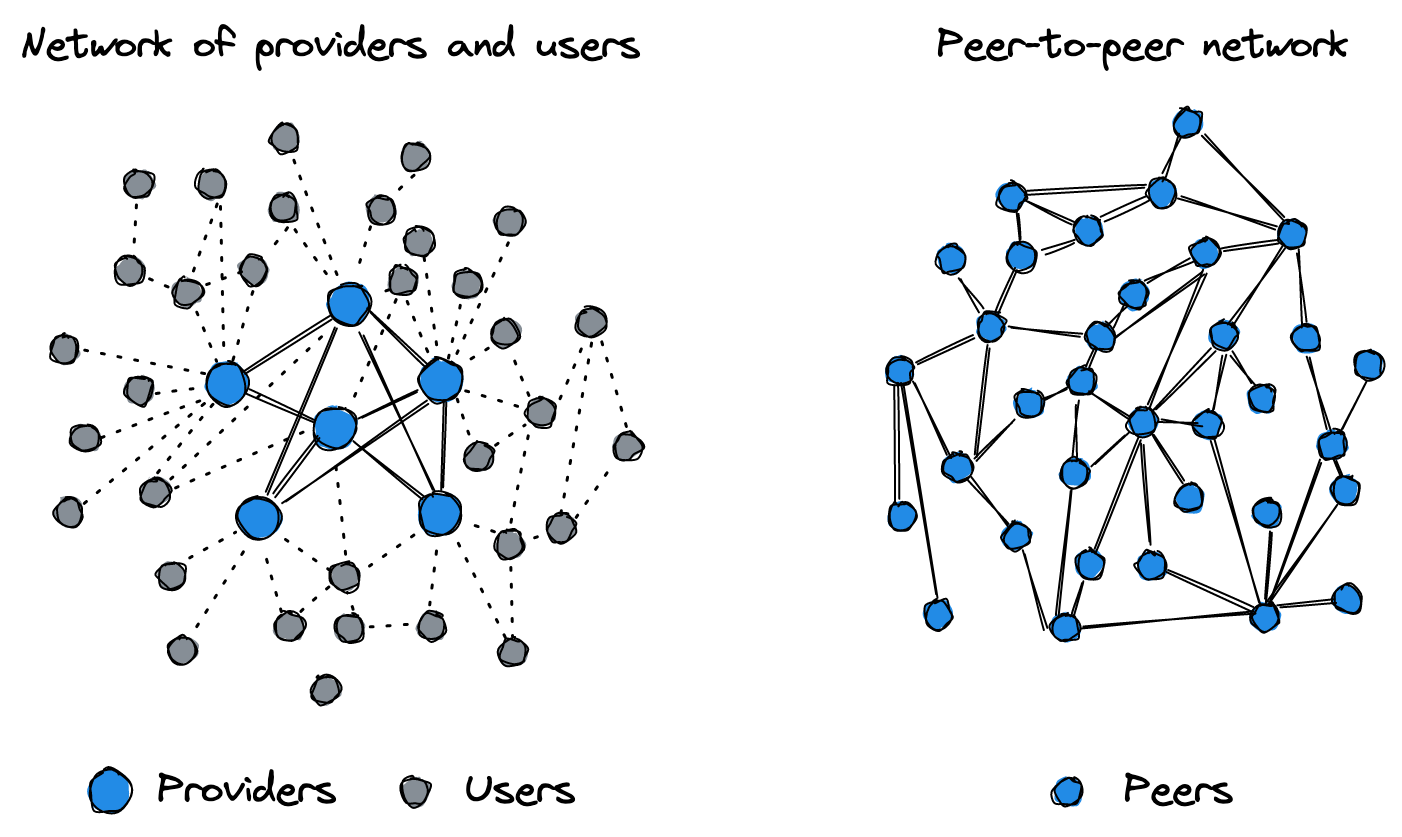

The Bitcoin network is famously “A Peer-to-Peer Electronic Cash System” (this is in the title of the Bitcoin whitepaper!). However, participants are split in practice:

- Miners commit transactions to the Bitcoin ledger with new blocks

- Non-mining nodes accept new transactions in their mempools and relay gossip

- Light clients or simple “users” of Bitcoin connect to node providers to get data and broadcast new transactions

The Lightning Network, however, is only composed of peer-to-peer relationships called channels. Channels are the pathways of the network, through which payments travel. All participants must open at least one channel to another participant to send and receive payments. The network is a big, amorphous graph of participants connected to each other with channels, all on the same level.

Aha! Transfers are “lightning” fast because…there are no transfers!

Surprise: the protocol outlined in the Lightning Network standards (“BOLTS”) does not define value transfer. At its core, the Lightning Network is a protocol for two participants to pool funds together and make commitments to splitting this fund pool. This split evolves over time, enabling “transfers”. For example, say I want to send you 0.5 BTC through a channel you and I have opened. At the moment there is 1 BTC on my side and 2 BTC on yours. If we both agree to split 0.5 BTC / 2.5 BTC instead of currently 1 BTC / 2 BTC, the transfer is done!

It’s easy to understand why these kinds of transfers are wicked fast: they’re not actually happening. Only commitments are exchanged between participants.

Aha! Funds are pooled via multisig, with pre-signed transactions as insurance!

You’re probably wondering how commitments actually work. It seems magic. Participants cannot trust each other, making this a hard problem. The Lightning Network solves this by pooling funds through multisig, and committing with pre-signed Bitcoin transactions.

Pooling. Pooling funds is done through a Bitcoin primitive you probably know already: multisig. Opening a Lightning channel is equivalent to funding a “2-out-of-2” multisig address. If you and I deposit funds into a 2-out-of-2 address, neither of us can unilateraly move these funds. That’s good but: how can I get my money back if you lose your key or go offline? What if you never agree to sign a transaction even when I’m just taking my fair share? This is where pre-signed Bitcoin transactions (also called “commitment transactions”) come in.

Committing. Agreeing on who owns what share of the fund pool is done via pre-signed offline Bitcoin transactions. These transactions are called “commitment transactions”, or “commitments” for short. They spend funds out of the multisig address and split them across the two channel partners. They provide an important guarantee: in case things go wrong, the commitment transactions can be broadcast and funds are sent out of the multisig address, back to the channel partners, according to the agreed upon split. Therefore, it’s crucial to put this guarantee in place before sending funds to the multisig address! (if you’re wondering how that’s possible, the next section on SegWit has answers for you!)

How are commitments put in place? Well, here are the messages exchanged to open a Lightning channel:

- [

open_channel] “Hey, I want to open a channel with you, you down?” - [

accept_channel] “Sure, sounds good to me!” - [

funding_created] “Before I sent funds to this new multisig address, mind signing this commitment transaction? That way I can get my money back if things go wrong.” - [

funding_signed] “Here you go!” - The channel opener send funds to the multisig address as promised. Meanwhile, the other partner monitors on-chain for confirmations…

- [

channel_ready] “Nice! I now see enough confirmations on this funding transaction. We’re in business!”

When a channel is open, 100% of the funds are allocated to the channel opener. To update the channel balance old commitments are revoked, and a new one established.

Aha! SegWit enables offline chaining of signed transactions!

SegWit solves the transaction malleability problem. Before SegWit signatures (aka “witnesses”) were part of the data hashed to produce transaction identifiers. This meant that the transaction hash (or ID) could change if the signature bytes changed. Given signatures aren’t deterministic (signers can pick different nonces, observers can also flip the “s” value or play with DER encoding to get the same signature encoded with different bytes), it was not safe to expect that a signed, off-chain transaction would keep its ID. The only safe way to get a reliable transaction ID was to broadcast it on-chain. As a result chaining signed transactions without broadcasting them was risky.

SegWit solves this by excluding (or, segregating) signatures (or, witnesses) from the data hashed to produce a transaction ID. As a result, a change in the signature won’t change the transaction ID. This is why it’s safe to rely on this ID to construct another transaction using it, even if it’s not broadcast on-chain.

This is fundamental for the Lightning network since commitment transactions (remember, they’re our “insurance”) have to be signed before funding transactions are broadcast, yet commitment transactions need the funding transaction ID to be constructed. In other words, the Lightning Network would not be able to function without SegWit and offline transaction chaining.

Aha! Bitcoin script and game theory to harden commitment outputs!

To update the channel balances, old commitments need to be revoked and a new one established. This is done with a simple exchange of messages:

commitment_signedcontains a new partially signed commitment (missing the recipient’s signature)revoke_and_ackacknowledges the commitment and revokes the last valid one

Commitment transactions are sophisticated, to prevent cheating. The idea is that if I cheat by broadcasting an old commitment, you should have some time to react and punish me. In practice this is implemented with revocation secrets: when revealed they let the other party redeem a “punishment” output, taking the other party’s share. That’s the financial incentive not to broadcast old commitments.

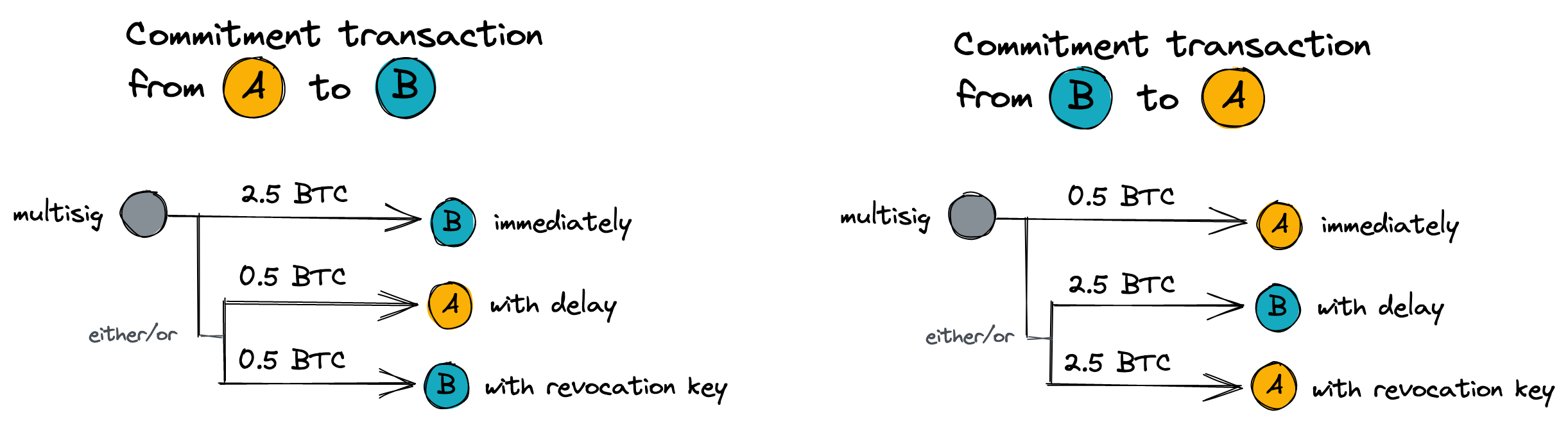

In order to implement punishment, commitments are non-symmetrical. The “punishment” outputs have different amounts and beneficiaries: you can punish me and claim my share if I broadcast an old commitment of mine to you, and I can punish you and take your share if you broadcast an old commitment of yours to me.

To allow for cheating detection and enforcement, commitments output are delayed

so that the party crafting them is forced to wait for a window of time to get

their fair share. This is to ensure the other party has time to detect cheating

and use their revocation secret if they so choose. The time delay is not

dictated by the protocol: it is agreed upon when the channel is open

(to_self_delay in open_channel)

To illustrate this, let’s take a concrete example. If A and B have a channel opened (split with 0.5 BTC for A, and 2.5 BTC for B), here are the commitment transactions on each side:

This looks complicated but the Bitcoin script to implement this is surprisingly simple. Below is the Bitcoin script for the “either/or” fork for A’s commitment to B:

OP_IF

# revocation secret can spend the funds immediately if A cheats

revocation_pubkey

OP_ELSE

# This Bitcoin OP is defined

# in BIP 112: https://github.com/bitcoin/bips/blob/master/bip-0112.mediawiki

# It ensures the current output can't be spent before time_delay

time_delay OP_CHECKSEQUENCE_VERIFY OP_DROP

# If the line above succeeds (gets off the stack with `OP_DROP`),

# public_key_for_A is able to spend the funds.

# This only happens after a delay because of OP_CHECKSEQUENCE_VERIFY

public_key_for_A

OP_ENDIF

# Checks signature for either revocation_pubkey or public_key_for_A

OP_CHECKSIG

There you have it, game theory and Bitcoin primitives coming together in this commitment transaction output!

Now let’s dive one layer deeper: how do revocation secrets work exactly? Remember that revocation secrets are powerful, you can claim my portion of the channel balance with it! How are they generated and how do they “revoke” commitments exactly?

Aha! Revoking a commitment is done by revealing a secret!

Revocation secret derivation is explained precisely in BOLT#3. However the technical nature of the spec masks the cleverness of its design. Let’s walk through it together!

Warning: this requires some knowledge of elliptic curve cryptography.

Click/Tap for a quick primer.

Here are the important concepts to grasp:- What are elliptic curves?

Short version: they're curves with the equation:y2 =x3 +ax+b. Instead of using real numbers, ECC computes all operations modulo a large prime number P - What is point multiplication?

Short version: take two points on an alliptic curve, find the intersection with the elliptic curve, then negate the y coordinate to obtain the "sum" point. Sum a point P with itselfxtimes and you have point multiplication:x*P! - How do public and private keys relate to elliptic curve points

Short version: private keys are just big integers. Public keys are points on the elliptic curve. A public key or point is obtained by point multiplication:pubkey = n*G, wherenis the private key andGis the generator of the curve;Gis arbitrarily chosen

If you want more details on ECC with awesome visuals, I highly recommend reading The Animated Elliptic Curve.

Back to the lightning network and revocation secrets!

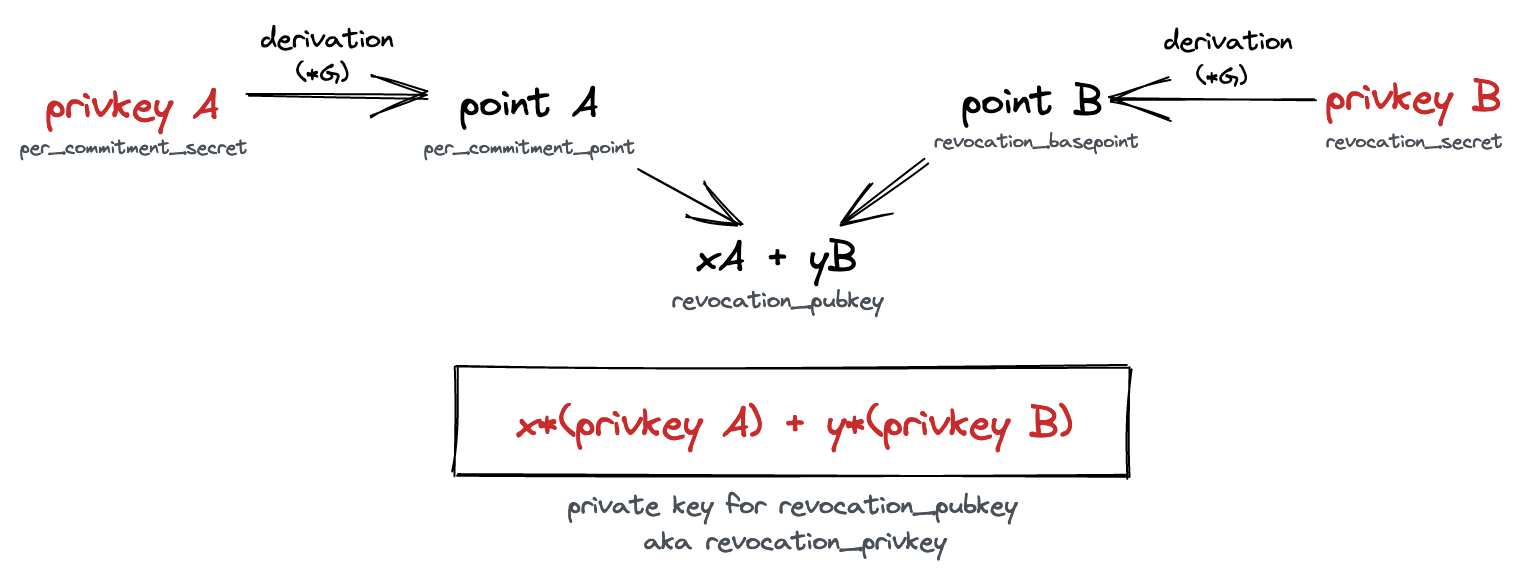

If two parties (let’s call them “A” and “B”) open a channel, they exchange two

(public) elliptic curve points as part of the flow: revocation_basepoint and

per_commitment_point. Revocation public keys (revocation_pubkey) are

composed from these two points:

To make the shared point deterministic, the Lightning Network picks x and y

based on values known to both parties:

revocation_pubkey =

revocation_basepoint

* sha256(revocation_basepoint || per_commitment_point)

+ per_commitment_point

* sha256(per_commitment_point || revocation_basepoint)

(In the above, || represents byte concatenation and * is ECC point

multiplication)

The associated private key is given by:

revocation_privkey =

revocation_secret

* sha256(revocation_basepoint || per_commitment_point)

+ per_commitment_secret

* sha256(per_commitment_point || revocation_basepoint)

To convince yourself that this works, multiply the above expression

by G and you’ll find that revocation_privkey * G results in revocation_pubkey.

Click/Tap to reveal proof

G * revocation_privkey

= G * (

revocation_secret

* sha256(revocation_basepoint || per_commitment_point)

+ per_commitment_secret

* sha256(per_commitment_point || revocation_basepoint)

)

= G * revocation_secret

^-------------------^ this is revocation_basepoint!

* sha256(revocation_basepoint || per_commitment_point)

+ G * per_commitment_secret

^-------------------------^ this is per_commitment_point!

* sha256(per_commitment_point || revocation_basepoint)

= revocation_basepoint

* sha256(revocation_basepoint || per_commitment_point)

+ per_commitment_point

* sha256(per_commitment_point || revocation_basepoint)

= revocation_pubkey (Q.E.D.)

revocation_pubkey can be computed by anyone since it’s composed of 2 public

points. The interesting piece is the revocation_privkey, composed of two

secrets spread across channel partners: revocation_secret and

per_commitment_secret.

revocation_secretis generated once upon channel opening. The associated public point (revocation_basepoint) stays the same during the lifetime of the channel.per_commitment_secretvalues are specific to each commitment.

To make this fast, they’re based on a single seed computed at the beginning. The derivation of subsequent secrets (one for each commitment) is explained in BOLT#3: Per-commitment Secret Requirements

It turns out “revoking” a commitment is the act of revealing its

per-commitment secret. The reveal is done with a field named

per_commitment_secret in the revoke_and_ack message. This

message also contains next_per_commitment_point such that the other party can

compute the next revocation_pubkey and use it to craft the next commitment

transaction. To make this more concrete, let’s illustrate this with our 2

channel partners, A and B:

- A generates a

revocation_basepointduring channel opening - B sends

per_commitment_point_1 - A crafts commitment #1 using

revocation_basepointandper_commitment_point_1, and sends it to B - B sends

per_commitment_secret_1(thereby revoking commitment #1), and sendsper_commitment_point_2to A - A crafts commitment #2, using

revocation_basepointandper_commitment_point_2, and sends it to B - B sends

per_commitment_secret_2(thereby revoking commitment #2), and sendsper_commitment_point_3to A - …and so on and so forth

revocation_basepoint and

A's series of per_commitment_point values.

Now it should be clear why commitment transactions never change, yet they’re

“revoked”: when the per_commitment_secret for a given commitment is revealed,

the other party can suddently compute the associated revocation_privkey and

redeem the commitment’s “punishment” output if it was ever broadcast on-chain.

This strong financial incentive is enough to keep old commitment transactions

offline for good.

Aha! Multi-hop, atomic payments with HTLCs!

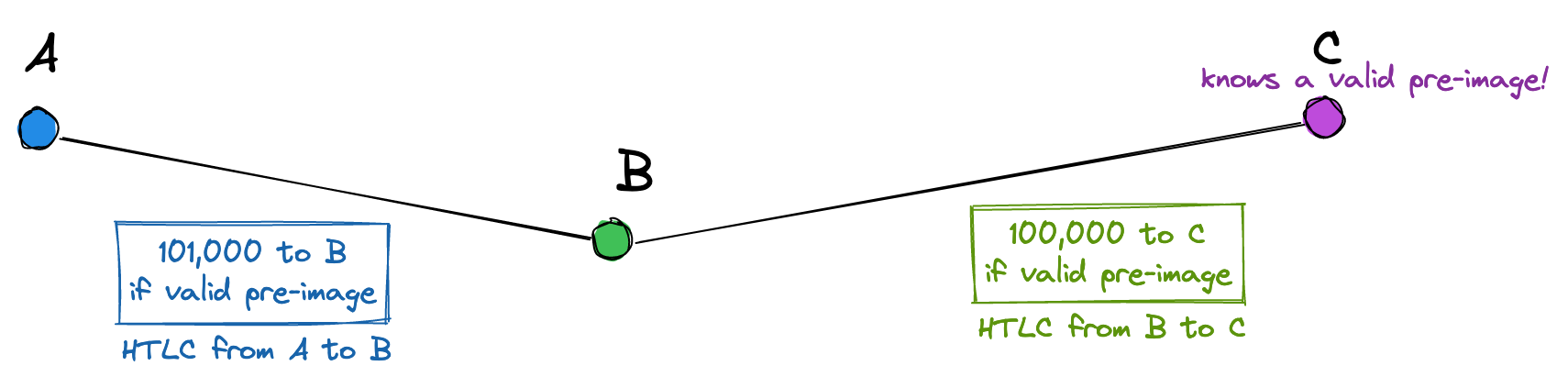

We’ve seen how the Lightning Network enables peer-to-peer payments. Now let’s move to indirect or “multi-hop” payments. If A has a channel open with B, and B has a channel opened with C, can A pay C?

Yes it can! Provided that there is a route with enough capacity from A to C,

not only can A pay C, it can do so atomically. Either all legs of the payment

(e.g. A->B, B->C) succeed, or all legs fail. This is possible at scale,

even with 10, 15, or 20+ intermediary nodes. If you’re used to the traditional

financial system where intermediaries cause hard-to-debug failures and long

settlement delays…isn’t this mind-blowing?

The Lightning Network does this with Hash-Time-Lock-Contracts (“HTLCs”). These contracts are “just” valid Bitcoin scripts. The basic premise is that an HTLC is a contract between 2 parties (1 issuer, 1 recipient), and it enforces the following:

- Funds can be spent by the issuer after a period of time (expiration clause)

- Funds can be spent immediately by the recipient if they provide a valid

pre-image (the “pre-image” of a hash

His an inputIwhich satisfieshash(I)=H)

Hence the name “HTLC”, HTLC contracts are Hash-locked contract from the point-of-view of the recipient, or Time-locked contract from the point-of-view of the issuer.

How are HTLCs helping with instant, atomic payments? Here’s how a payment from

A to B to C happens in practice:

(note: if you’re wondering

why “B” was picked as an intermediary, we’ll see later that path

discovery isn’t explicitly part of the BOLT specs! Another interesting

aspect of the Lightning Network design)

- C creates a lightning “invoice” to A for 100,000 satoshis (0.001 BTC). This could be communicated over an email, through a web-based checkout flow, via an in-person QR code, etc. At the core of this invoice is a hash H. The pre-image is only known by C.

- A issues an HTLC to B, locking 101,000 satoshis in an HTLC output. Remember: this HTLC can be spent by A after expiration, or by B if they provide the correct pre-image.

- B issues an HTLC to C, locking 100,000 satoshis. Note the different amounts in the HTLC issued by A (101,000 satoshis) vs. B (100,000 satoshis). The difference (1,000 satoshis) is the fee that B collects for forwarding the payment through its channel with C. It compensates B for the inconvenience of locking funds temporarily.

- C can now get paid by redeeming the HTLC, because it knows a valid pre-image for hash H (this pre-image was used to generate the original invoice)

To redeem the HTLC, C can broadcast a transaction containing a valid pre-image. Doing this will reveal the previously secret pre-image because it’s publicly on-chain! The public reveal of the pre-image makes all HTLCs spendable by their recipients. In our example, B can now unlock the HTLC offered by A and redeem 101,000 satoshis.

This is how atomic payments are enabled: regardless of the number of intermediaries, either all HTLCs become spendable when the pre-image is publicly revealed, or none of them do.

In practice broadcasting on the Bitcoin network isn’t efficient because it incurs fees. Instead, C can send the pre-image to B, thereby prooving it could redeem the HTLC if it wanted (by going on-chain). This is enough for B to get comfortable and update the (B,C) channel balance, sending 100,000 satoshis to C.

Once B has updated the (B,C) channel balance, B can send the pre-image to A. For the same reason, A prefers to settle the HTLC off-chain and send 101,000 satoshis to B through the (A,B) channel.

For the curious reader: what's the incentive not to broadcast HTLCs on-chain after off-chain settlement is done?

You may have noticed an incentive problem in the previous example: why would C not broadcast the HTLC on-chain after the channel balance is updated? After all, C has the pre-image so why not take the money twice? Once from the off-chain settlement through B's balance update, the second on-chain with the HTLC broadcast!To fix this, the Lightning Network incorporates HTLCs into commitment transactions. In other words, B doesn’t simply send an HTLC to C. B and C actually exchange commitment transactions which include the HTLC as an extra output.

Specifically, the commitment transaction from B to C has the following outputs:

- output to B for B’s balance minus 100,000 satoshis (delayed)

- output to C for C’s balance (immediate)

- output to C for B’s balance minus 100,000 satoshis (immediate with revocation key)

- output to HTLC for 100,000 satoshis

And the commitment transaction from C to B has the following outputs:

- output to C for C’s balance (delayed)

- output to B for B’s balance - 100,000 satoshis (delayed)

- output to B for C’s balance (immediate with revocation key)

- output to HTLC for 100,000 satoshis

When C reveals the pre-image to B and B updates the channel balance with a new commitment, C has to send B the revocation key to revoke the previous commitment. This means that C can’t “double claim” the HTLC: once it’s settled off-chain, the corresponding commitment becomes obsolete. B can punish C with the revocation key if C decides to broadcast it on-chain!

Bonus: Significance of Taproot upgrade and Schnorr signatures

I’ve never connected Schnorr signatures with the Lightnint Network before. The relationship is that Schnorr signatures unlock Point Time-Locked Contracts (PTLCs). PTLCs are “Bitcoin scripts that allows a conditional spend either on the presentation of a secret or after a certain blockheight has passed, similar to an HTLC. Unlike HTLCs, PTLCs do not depend on a preimage of a hash function but rather on the private key from an elliptic curve point. The security assumption is thus based on the discrete logarithm. PTLCs are not yet implemented on the Lightning Network” (taken from the Mastering the Lightning Network’s glossary)

Bonus: Choosing NOT to design payment routing

Designing is making choices. It’s also choosing NOT to make a choice, to leave room for experimentation and innovation within the protocol boundary.

I was a bit shocked to learn that there is no standard on how to route payments in lightning. The probing for channel balances happens independently, through trial and error. Some papers have been written on how to do this independently. There’s also, in the same category, innovation on how to manage channel liquidity. For example: Loop.

This is how lightning “scales”. The protocol itself doesn’t mandate anything, actors within the lightning community are coming up with bottom-up solutions like these, getting better and better over time.

Bonus: No networking needed!

Then I realized: opening payment channels, evolving commitments, and closing channels can all be done by exchanging messages on USB drives or paper, fully offline. These messages do not have to follow BOLT standards as long as the structure of the commitment transactions is kept intact (validity of transactions on-chain is key to enforcing incentives and preventing cheating).

Nothing mandates a “network” for pure peer-to-peer payment to work. The design is extremely resilient: no privileged node assumption (all nodes are participants, all participants are nodes!), no speed or hard protocol requirement for message exchange, and no trust assumptions even for direct peers. Thanks to cryptography and game theory the only real assumption in the Lightning Network is reliable access to the Bitcoin Network, to detect and punish cheaters.

This makes the design of the Lightning Network applicable broadly:

- banks or exchanges could run lightning-like protocols to send crypto back and forth at high frequency without on-chain transactions in a trustless way.

- Other chains could (actually: already have!) implemented the same ideas to power peer-to-peer payments on top of their base layer.

- Taro (Taproot-Native Asset Overlay) is another promising proposal to onboard foreign assets into Lightning. To learn more, see this presentation from Bitcoin 2022, this wiki from Lightning Labs, or this excellent explainer by River Financial.

Conclusion

If you’ve made it this far, thank you for reading. We’ve covered quite a lot of ground and have seen that:

- the Lightning Network is a pure peer-to-peer network, unlike its base layer

- the Lightning Network is a way for 2 parties to exchange commitments about a common pool of funds. It’s not (directly) about transfers!

- the Lightning Network cleverly mixes game theory, cryptography, and Bitcoin primitives to guarantee participants' safety

- the Lightning Network needs SegWit to work at all because transaction chaining and pre-signed transactions are at the heart of commitments

- the Lightning Network uses HTLCs to enable atomic, multi-hop payments

I highly recommend reading the full version of Mastering the Lighning Network (Amazon link, Github link) if you’re looking to learn more about the Lightning Network. The design principles behind it are worth dissecting. I hope you’ll get as much satisfaction as I did while diving in!